Contents:

Let’s say Sita sells her future contract to Karishma for Rs 1.1 crore. Thus in this case, now the contract is between Karishma and Noor with Karishma holding the long position. Open Interest remains the same, as no new contract was created. Thus, basis would be Rs 10 lakh (1.1 – 1), as it represents the difference between the current market price of the future contract and the current price of the underlying. Next day one more contract got opened between a new buyer and seller. Thus the open interest became 14, but the volume for that day was just 1 as only one contract got executed.

One of the concepts an intraday trader has to understand is open interest. Increasing open interest means that new money is flowing into the marketplace. Declining open interest means that the market is liquidating and implies that the prevailing price trend is coming to an end. Therefore, open interest provides a lead indication of an impending change of trend.

Study finds market power drove pandemic food inflation – Food & Environment Reporting Network

Study finds market power drove pandemic food inflation.

Posted: Thu, 04 May 2023 22:53:02 GMT [source]

In the above example Rs.165 strike price has the highest call option OI as well as recorded the highest percentage increase in OI over the previous day. We have already explained that access to the right to buy is a call option. In our example Sita got the right to buy Noor’s house and we established that she holds a long position in a call option contract.

[Free Course] Mini Certification on Options Trading in Indian…

In our example of Sita and Noor, at 1.1 crore future contract price is different from the fair value price of Rs 1.03 crore. Let’s assume that the current bank interest rate is 6% pa. Keeping things simple and not counting in compounding, Sita will be able to earn 3% returns in 6 months on her investment. So if Sita invests Rs 1 crore in the bank today, she will have Rs 1.03 crore after 6 months. If the future contract was priced at Rs 1.03 crore, instead of Rs 1.1 crore, Sita would have been indifferent in buying the house today or after six months.

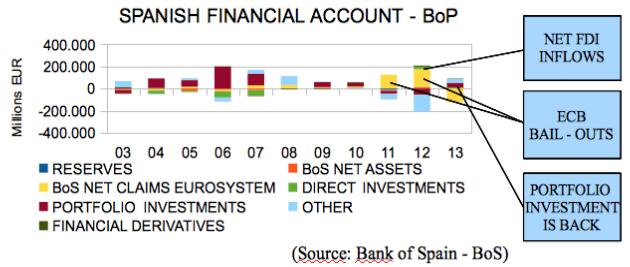

Exclusive: ECB policymakers converging on 25-bps rate hike in May – Reuters

Exclusive: ECB policymakers converging on 25-bps rate hike in May.

Posted: Thu, 13 Apr 2023 07:00:00 GMT [source]

While selling a futures contract means a promise to transfer assets to the buyer at a specified price and duration. This is an indication of short build up in the stock futures. One could be a negative view of the stock which is inducing traders to sell the futures. Alternatively, it could also be a case of fresh arbitrage positions being built in the stock, wherein traders buy in the cash market and sell in the futures for assured spreads. An arbitrage is actually positive for the markets but also indicates that traders are not entirely bullish. Fresh shorting could either be due to structural reasons or purely as a short-term trade.

Understanding Open Interest and It’s Importance in Trading!

When the price moves out of the trading range, these traders are forced to abandon their positions. It is possible to take this rule one step further and say the greater the rise in open interest during the consolidation, the greater the potential for the subsequent move. In case of futures, the inter-relationship of price action and open interest change is studied to analyze Open interest data.

- In the above example Rs.165 strike price has the highest call option OI as well as recorded the highest percentage increase in OI over the previous day.

- High open interest at market tops is a bearish signal if the price drop is sudden, since this will force many ‘weak’ longs to liquidate.

- Open Interest or OI data changes day by day depending on the outstanding contracts.

- Similarly 12 put options are open that will expire next month and 3 open put options will expire the month after that.

Money is therefore leaving the marketplace and is considered bearish. Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. Please note that in case of default of a Member, claim for funds and securities, without any transaction on the exchange will not be accepted by the relevant Committee of the Exchange as per the approved norms.

increase in open interest increase in price does like Noor’s apartment but is not able to pay immediately. Her money is locked in fixed deposit which will mature in 6 months and Sita does not want redeem it before the maturity date. However she wants to seal the deal and agree on the purchase consideration as she is concerned that prices might go up in the future. However since she has not yet found another rented accommodation to move into, she wants some grace time before handing over the possession of the apartment to Sita. Hence Sita enters into an agreement with Noor to buy the house after six months for a consideration of Rs 1.1 Crore. This way both were able to achieve their respective objectives.

Explore Mutual Funds

Open Interest shows the total number of contracts, in the Futures & Options market, that are yet to be settled. To be more specific, it shows whether the flow of money in the Futures & Options market is increasing or decreasing. If prices are rising and open interest is increasing at a rate faster than its five-year seasonal average, this is a bullish sign.

Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Based on an options chain analysis, the range is between Rs 220 and Rs 250. Info Edge on a sideways tripInfo Edge ’s daily trend is sideways. Based on the options chain analysis, the range is between Rs 3,300 and Rs 4,000. The ratio is calculated by dividing the number of traded put options by the number of traded call options.

Case 3: If price increases and open interest decreases

However in case of futures contracts traded on national stock exchange, the contracts are available in 1 month, 2 month and 3 month time frame. The time frame up to which the contract lasts is called ‘The expiry’ of the contract. While all the leading institutional investors use Capitaline databases, Capital Market magazine gives access to the databases to individual investors through Corporate Scoreboard. Besides stock market and company-related articles, the magazine’s independent and insightful coverage includes mutual funds, taxation, commodities and personal finance. Open interest equals the total number of active, open contracts; it is not a sum of each transaction by every buyer and seller nor does it represent trades executed.

To ensure smooth settlement of trades, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement. Open Interest is something you must be familiar with in order to make decisions regarding investments. You cannot speculate the money blindly when it comes to investing in derivatives. Here, you have to keep an eye on the increasing and decreasing trends of Open Interest as well as price. Because with all the possible combinations, the market results will have a wide range.

The compensation is because Noor will have to maintain the apartment for 6 months and is liable to pay property taxes, maintenance expenses etc. Let’s assume Sita agrees to pay Rs.5 lakh immediately to Noor. By doing so, Sita is buying the right to buy Noor’s apartment after 6 months at a predetermined price of Rs 1.1 crore and Noor is charging her some premium to grant this right.

Recall that though Sita likes Noor’s apartment and is keen on buying it, as her money is locked in fixed deposit maturing in 6 months she is not able to pay for the apartment immediately. Sita is also concerned that house prices will rise in the future and is keen to lock in the price as of today. Noor is selling the house so that the proceeds can be utilized to set up a catering business.

How are Futures and Options traded?

A Technical Score above 59 is considered good and below 30 is considered bad . The Valuation Score tracks how expensive the stock is versus its peers. Valuation scores above 50 are considered good and below 30 are considered bad .

Volume is indicative of how many trades were conducted on any given day. OI, on the other hand, has implications on the next day, and is live data in that sense. If the prices are on a downward trend and the OI is also dipping, it means holders are under pressure to liquidate their positions. Traders should also understand that open interest is not the same as volume. Volume is a reflection of the number of contracts that have occurred between seller and buyer; irrespective of whether a new contract has been created or an existing contract has been transaction. The basic difference between OI and volume is that while open interest indicates the number of contracts that are open and live, volume indicates how many were executed.

Open interest has to do with derivative contracts like futures and options. It basically is the total number of outstanding open contracts at the end of a trading day. Now, when a fresh position is initiated, the open interest goes up. And when the position is closed, the open interest goes down. While volume resets each day, Open Interest gets carry forward to the next day and gives vital information regarding market trends, liquidity and could be used to earn profits from futures and options markets. Here, bullish market represents a strong market, while bearish means a weak market.

One has an option to view all the contracts at once or to view individual contracts. Writing/ selling options or trading in option strategies based on tips, without basic knowledge & understanding of the product and its risks. Open interest becomes more complicated when you consider that each of the traders is buying/selling from someone else who is selling/buying. But in the huge market, sometimes both parties will be only opening trades and increasing open interest; or one party will be closing a trade and the other opening resulting in no effect on open interest. And a lot of times, both parties could be closing trades and dropping the open interest. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal.

- Over the years the scope of the databases has enlarged to cover economy, sectors, mutual funds, commodities and news.

- Volume is a reflection of the number of contracts that have occurred between seller and buyer; irrespective of whether a new contract has been created or an existing contract has been transaction.

- Technical/Fundamental Analysis Charts & Tools provided for research purpose.

- Now, if the price action is rising and the open interest is on the decline, short sellers covering their positions are causing the rally.

Let’s start with a small story that will allow us to better understand the working of futures market. Two women, Sita and Noor are both active in the housing market of Mumbai. Noor is planning to sell her 2 bedroom apartment for about Rs.1 crore and utilize the proceeds to set up a catering business. While first and third scenarios of interpretation of open interest charts indicate direction of future market trend , other scenarios does not indicate a clear trend. Traders can wait for clarity in open interest data or use other indicators to initiate positions. This lists down contracts and instruments in terms of increased open interest and increase in price for the day.

This means that if Sita wants to sell her position in the contract there are buyers who will be willing to pay her Rs 1.1 crore to enter into the futures contract with Noor. Just as in stock prices, future contract prices are also determined by demand and supply pressures of market. If there are too many people buying the future contract of Reliance, its price will go up. Similarly, if there are too many traders selling the future contract of HDFC, its price will come down. This price will always remain close to the fair value which we determined above, but might vary depending upon the current market demand and supply.

Rising open interest indicates new money is coming into the market and the present trend is likely to continue. Thus, at the end of the first day, volume and open interest are at a count of nine. Click here to know which stocks have seen a sudden increase in Open Interest.

OI is the total number of outstanding derivative contracts that are yet to be settled. Bank Nifty Option Chain shows you a list of all available options, for Bank Nifty. Another thing, in Option day trading “Volume” never go down/decrease, then how this logic may be applied.

The Quality Score is based on company’s financial and management quality and long term performance. Quality scores above 55 are considered good and below 35 are considered bad . Whereas, scores between are considered neutral/Medium/Middle . To get access please email on from your registered email-id or contact you Relationship Manager. When an existing position holder squares off with entry of a new entrant, open interest remains unchanged. When a new entrant trades with a new entrant in the F&O market, then the Open Interest goes up.

Always remember that the option lies with the buyer of the call/put contract. Call option buyer has the right to buy and thus an option to buy or not, as per her wish. But if she wants to buy, seller of the option is obligated to sell the underlying.